AI at Work

6 Ways Generative AI Makes Marketing Teams in the Insurance Industry More Effective

Akshita Sharma · Content Marketing Associate

July 31st, 2025 · 8 min read

The insurance industry, long weighed down by operational inefficiencies due to its data-rich processes and content-intensive workflows, is witnessing a quiet revolution as generative AI rewrites the rules of engagement.

IBM's recent industry analysis reveals that 77% of insurance executives know they need to swiftly adopt generative AI to stay competitive in the market.

It's no longer a question of whether to adopt generative AI, but how to do it effectively. And the industry's marketing operations demand precisely what generative AI excels at: creating contextually appropriate (and compliant) content at scale.

Here’s how the combination of generative AI, customer data, and brand governance is allowing marketing teams at major insurance companies to move faster and get better results.

What role does generative AI play in creating targeted marketing campaigns for insurers?

Generative AI helps insurers create marketing campaigns that genuinely match what customers want, using the customer data they already have.

Insurance companies know more about their customers than almost any other industry. Every policy application, claim, life change, and interaction creates a detailed picture of individual needs and preferences.

But the challenge has always been connecting those dots to create marketing content that feels meaningful rather than intrusive. Generative AI makes those connections naturally. It offers unique capabilities that are particularly relevant to the insurance context, because it can:

Interpret complex data

Create human-like content across multiple touchpoints based on that data

Optimize your content to improve results over time

In practice, generative AI can be used to craft personalized campaigns, automate processes, and streamline content operations.

This means insurers can move beyond one-size-fits-all campaigns to deliver the right message to the right person at the right moment. Campaign development cycles shrink from weeks to days.

Your marketing team also spends less time on manual content creation, and more time on strategic thinking and relationship building. Resource allocation becomes more efficient as human experts can focus on higher-value activities.

How can generative AI be used in insurance?

Here are six ways GenAI in insurance is helping top marketing teams right now:

1. Personalized customer communication and campaigns

Most insurance companies still send the same generic messages to different customer segments, hoping something sticks. It doesn't work. And customers notice. Generative AI solves this problem by creating truly personalized communications at scale.

How does generative AI help insurance marketers create compliant and personalized content at scale?

Generative AI platforms analyze customer data (demographics, behaviors, life events, purchase history) and then generate tailored messages that speak directly to individual circumstances and needs (such as sending targeted home insurance offers after a property purchase).

AI-driven personalization increases conversion rates, customer engagement, and retention by ensuring communications are timely and relevant.

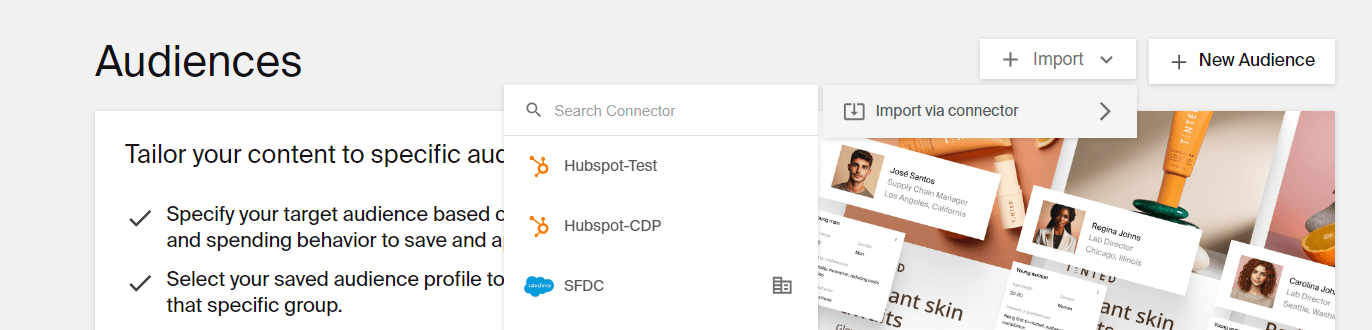

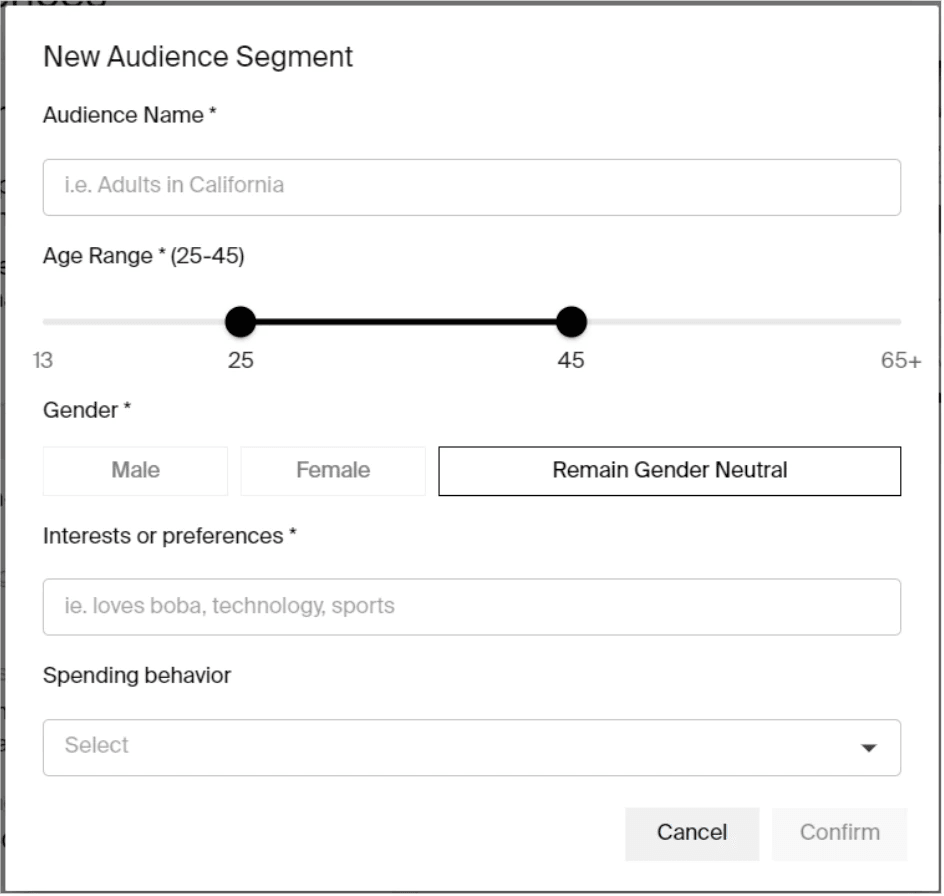

Typeface's dynamic audience personalization feature is specifically designed for this purpose. You can import your customer segments directly from your customer data platforms (CDPs)

Or create custom audience profiles with demographic details, behavioral data, and purchasing patterns on the platform.

Here's how insurance companies are using AI for marketing

Here's how insurance companies are using AI for marketing

One national insurance provider uses Typeface to personalize their images and copy for specific customer segments across the entire U.S., starting with a limited number of pre-approved, brand-compliant assets.

2. Automated content creation

The content creation process in insurance marketing has remained fundamentally unchanged for decades. Teams draft copy, circulate for approvals, revise based on feedback, repeat until everyone signs off, then adapt for different channels. It's methodical, but painfully slow.

Generative AI can help streamline this workflow.

How can AI-driven content creation improve efficiency for insurance marketing teams?

Marketing teams can use generative AI to rapidly create and edit promotional content, personalized communications, and customer support resources for their campaigns.

AI content repurposing can extract the core messaging of your insurance products and adapt it for different customer segments or markets. This dramatically reduces the time spent on repetitive content tasks. (Example: Writing copy for an integrated ad campaign tailored to specific customer profiles.)

Modern AI platforms like Typeface can also help resize images and adjust copy length for various channels, including email campaigns, social media, websites, and direct mail (e.g., brochures). This way, a single campaign asset becomes the foundation for multichannel marketing campaigns without manual intervention at each step.

The quality improvements are as significant as the speed gains. AI ensures every piece of content maintains brand voice, follows regulatory guidelines, and stays aligned with approved messaging, which eliminates the risk of off-brand or non-compliant materials slipping through. This reduces the revision cycles and approval delays.

And when you’re using a unified workspace like Typeface, teams can create, edit, approve, and distribute AI-generated marketing materials without needing to switch between different tools.

3. Data-driven insights and campaign optimization

You might be generating massive amounts of customer data but still end up drowning in information while starving for insights. As a result, most marketing teams end up making campaign decisions based on intuition and limited analysis rather than comprehensive data intelligence.

AI solves this pain point too. Rather than launching campaigns and hoping for the best, AI enables truly data-driven decision making at every step of the customer journey.

What role does AI play in analyzing marketing data and optimizing campaign performance for insurers?

Generative AI analyzes vast amounts of customer and campaign data to uncover actionable insights, such as identifying which marketing strategies resonate with specific segments.

AI-powered analytics help predict customer needs, guide future campaigns, and optimize digital marketing (e.g., ad targeting, keyword suggestions, budget allocation).

These insights enable continuous improvement of marketing effectiveness while respecting data privacy regulations.

With Typeface's Email Agent, you can create customized email campaigns for different customer segments. It pulls in all the needed information, like brand rules, market insights, audience details, and content from the Brand Hub, making sure every email is highly relevant.

4. Regulatory compliance and content governance

Insurance marketing compliance is notoriously complex and time-consuming. Legal teams spend countless hours reviewing campaigns, marketing teams wait weeks for approvals, and everyone worries about regulatory missteps that could cost millions in fines.

AI can restructure this process to reduce delays without increasing risks. Instead of retroactive compliance checking, AI embeds regulatory requirements directly into the content creation process.

How does AI ensure marketing materials meet regulatory requirements in insurance?

Generative AI helps ensure all content and campaigns comply with legal, regulatory, and brand guidelines through centralized hubs for brand-compliant content and AI marketing agents to monitor implementation.

AI can automatically flag non-compliant content before publication, reducing risk and manual review workload.

Typeface's Brand Hub maintains approved content libraries, regulatory guidelines, and brand standards in a single platform. Teams can create compliant campaigns quickly using pre-approved assets while the Brand Agent automatically monitors potential issues before content goes live.

This emphasis on personalization and control directly addresses the insurance industry's critical need for compliant and consistent communication. The platform also incorporates robust features for brand safety, security, and governance to protect sensitive data.

5. Enhanced customer engagement and loyalty

With the old "set it and forget it" approach, customer interactions end up revolving around policy renewals, claims, and payment issues. This leaves enormous gaps in the customer relationship. Gaps that competitors can exploit with more engaging, proactive communication strategies.

Generative AI can help you nurture stronger relationships and loyalty among policyholders.

How can generative AI help insurance marketers respond to evolving consumer search behaviors and preferences?

AI tracks how customers research insurance topics, what questions they ask most frequently, and which content formats they prefer. This intelligence can help shape communication approaches.

Generative AI can help create tailored marketing messages that automatically adjust tone, complexity, and product focus based on individual customer profiles.

AI-driven engagement strategies help insurers anticipate customer needs and proactively address them, improving satisfaction and long-term retention.

Typeface not only allows you to build personalized content, but also helps you optimize that content over time so that it stays relevant and keeps up with your audience. The result is that people value your content, and keep coming back.

The top marketing teams in insurance are already using GenAI to their advantage. Join them.

By leveraging generative AI platforms like Typeface, insurance companies can simultaneously reduce operational costs and enhance customer experiences. That's because Typeface empowers insurance professionals to focus on high-value activities by automating routine content creation while ensuring compliance with industry regulations and brand guidelines.

With 42% of insurers already investing in GenAI and another 57% planning to do so, now is the perfect time to explore how generative AI can benefit your business.

Request a Typeface demo today and join the growing community of insurance leaders who are leveraging generative AI to streamline operations.

Share

Related articles

AI at Work

7 Generative AI Use Cases in Enterprise Marketing

Neelam Goswami · Content Marketing Associate

November 12th, 2024 · 15 min read

AI at Work

AI Agents in Marketing: Orchestrating Autonomous Marketing Tasks

Neelam Goswami · Content Marketing Associate

June 27th, 2025 · 13 min read

AI at Work

AI Brand Management: How to Maintain Brand Consistency With AI Image Generators

Neelam Goswami · Content Marketing Associate

November 26th, 2025 · 13 min read